Call option profit formula

The buyer of the call option has no upper limit on the potential profit and a. Net profit on call option on HP stock total option value option cost 11000 5000 2 1000.

How To Calculate Payoffs To Option Positions Video Lesson Transcript Study Com

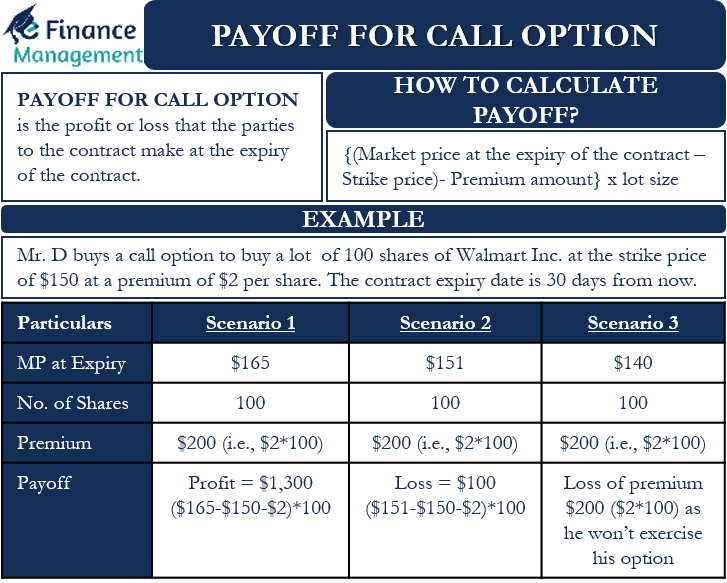

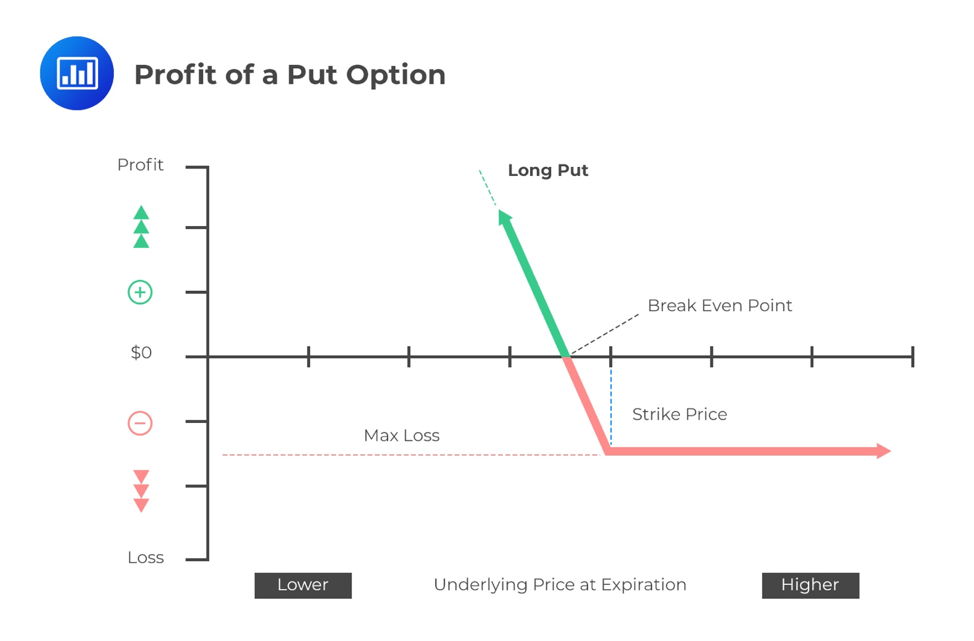

The value of a call option is the excess of the price at which we can sell that underlying asset in the open market the underlying price and the price at which we can buy the underlying asset the exercise price.

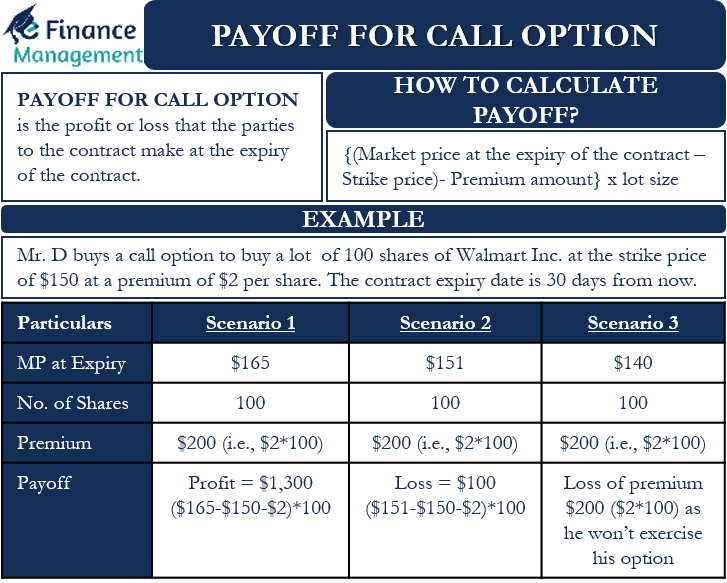

. Call Option Example 3. The breakeven price is equal to the strike price plus the premium paid. The same formula is applied for put options.

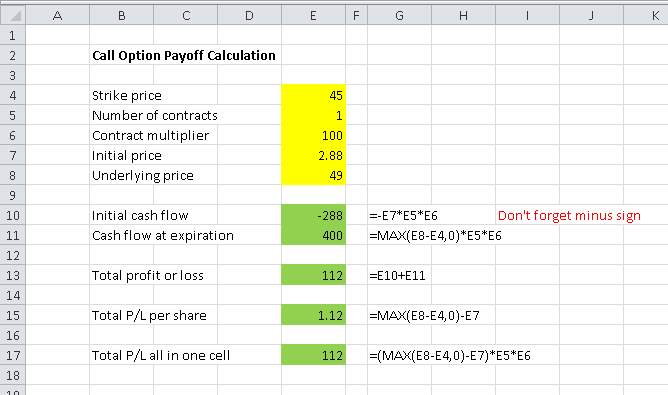

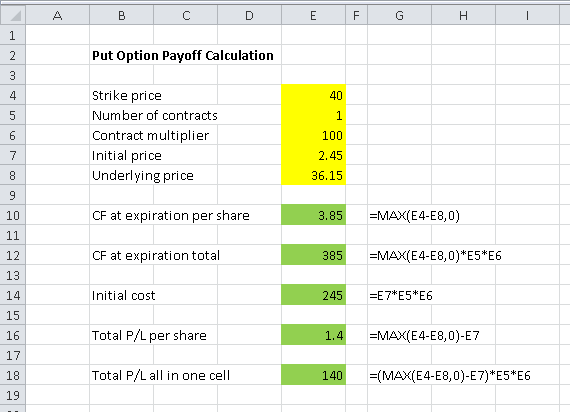

This can be repeated for the put option. An call options Value at expiry is the amount the underlying stock price exceeds the strike price. Calculate u and d.

Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. If you set the upper slider bar to the breakeven level of 14850 this would equal the approximate Delta of. Profit Strike Price Underlying Price Initial Option Price x number of contracts Using the previous data points lets say that the underlying price at expiration is 50.

R The risk free rate. Probability of earning a profit at expiration if you purchase the 145 call option at 350. Profit for a call seller max0ST Xc0 m a x 0 S T X c 0 where c0 c 0 the call premium.

To convert this figure into a percentage value reflective of total return divide the profit by the total purchase price of the asset and then multiply the resulting figure by 100. The risk free rate should be provided Combine π with c and c - to value the call. Steps for solving the value of a call option with the single period binomial model.

The options price when you bought it. Since the option will not be exercised unless. Profit 8 x 100 x 3 contracts 2400 minus premium paid of 900 1500 1667 return 1500 900.

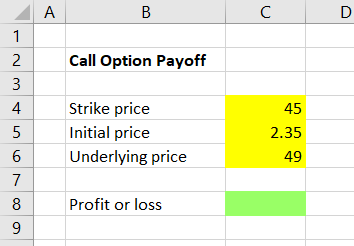

To start select an options trading strategy. The Profit at expiry is the value less the premium initially paid for the option. To calculate the profit on a call option take the ending price of the stock less the breakeven price of the long call and multiply the result by 100.

Basic Long Call bullish Long Put bearish Covered Call Cash Secured Put Naked Call bearish Naked Put bullish Spreads Credit Spread Call Spread Put Spread Poor Mans Cov. 3 Divide sum additional profit on exercise time value by net trade debit. Purchase of three 95 call option contracts.

Call Option Payoff Diagram Formula And Logic Macroption

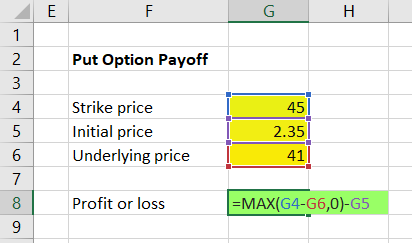

Calculating Call And Put Option Payoff In Excel Macroption

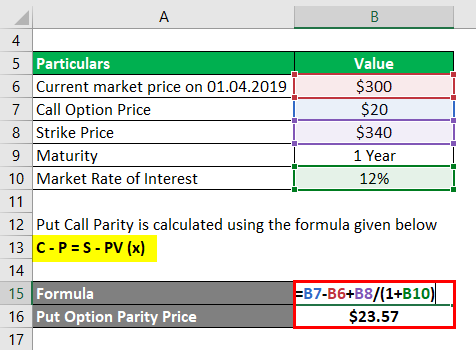

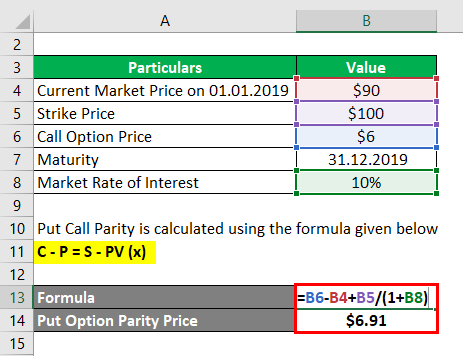

Put Call Parity Formula How To Calculate Put Call Parity

Payoff For Call Option Meaning Calculation And Examples

Value At Expiration And Profit For Call And Put Options Analystprep Cfa Exam Study Notes

Put Option Payoff Diagram And Formula Macroption

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

Put Call Parity Formula How To Calculate Put Call Parity

Call Option Understand How Buying Selling Call Options Works

Put Call Parity Formula How To Calculate Put Call Parity

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

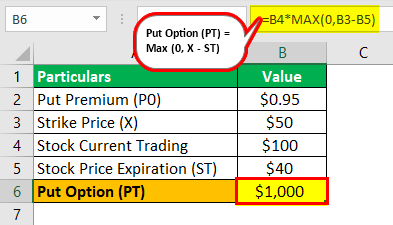

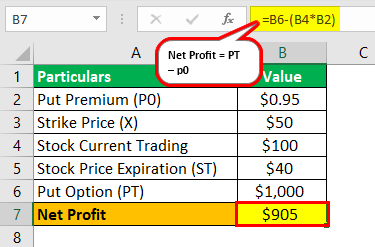

Put Option Meaning Explained Formula What Is It

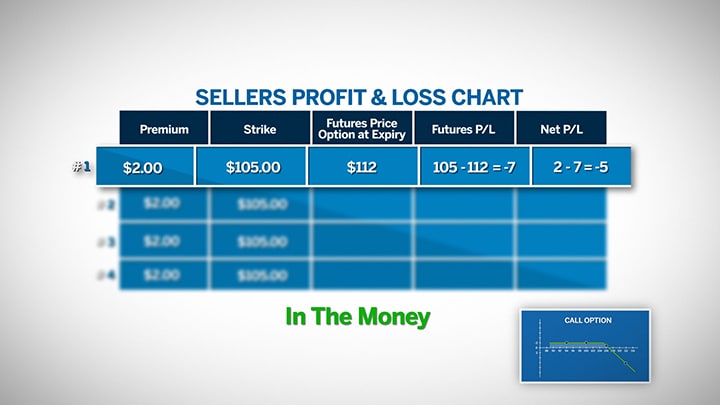

Understanding Options Expiration Profit And Loss Cme Group

Put Option Meaning Explained Formula What Is It

Calculating Call And Put Option Payoff In Excel Macroption

:max_bytes(150000):strip_icc()/dotdash_Final_Measure_Profit_Potential_With_Options_Risk_Graphs_Mar_2020-01-91faf67825434baba1a46837f4bf1ef3.jpg)

Measure Profit Potential With Options Risk Graphs

Calculating Call And Put Option Payoff In Excel Macroption